Understanding Federal Revenue and Budget Trends

The U.S. federal budget is a complex system that reflects national priorities and impacts nearly every aspect of public life. A public budget is a financial plan that outlines how the government collects and spends money to address public needs and achieve policy goals in a specific period, typically a fiscal year. With trillions of dollars involved, understanding the budget’s composition helps citizens understand how public funds are managed and how they affect their daily lives. This piece attempts to demystify and provide an overview of how the U.S. government generates revenue, its spending priorities, and how it affects Americans and global citizens at large.

Similar to how your personal budget requires funds for expenses such as bill payments, grocery shopping, or vacation planning, the government also needs money to function effectively. It provides security, health, and educational services, among other things. The government budget serves as a key tool for guiding public policy, ensuring that resources are allocated effectively to achieve government goals and priorities. It is primarily made up of the revenue and expenditure components. Revenue is the amount of funds expected to be collected through the calendar year from different sources, while expenditure is the government’s planned spending on various programs, services, and activities, such as healthcare, education, infrastructure, and defense.

Where Does the Money Come From?

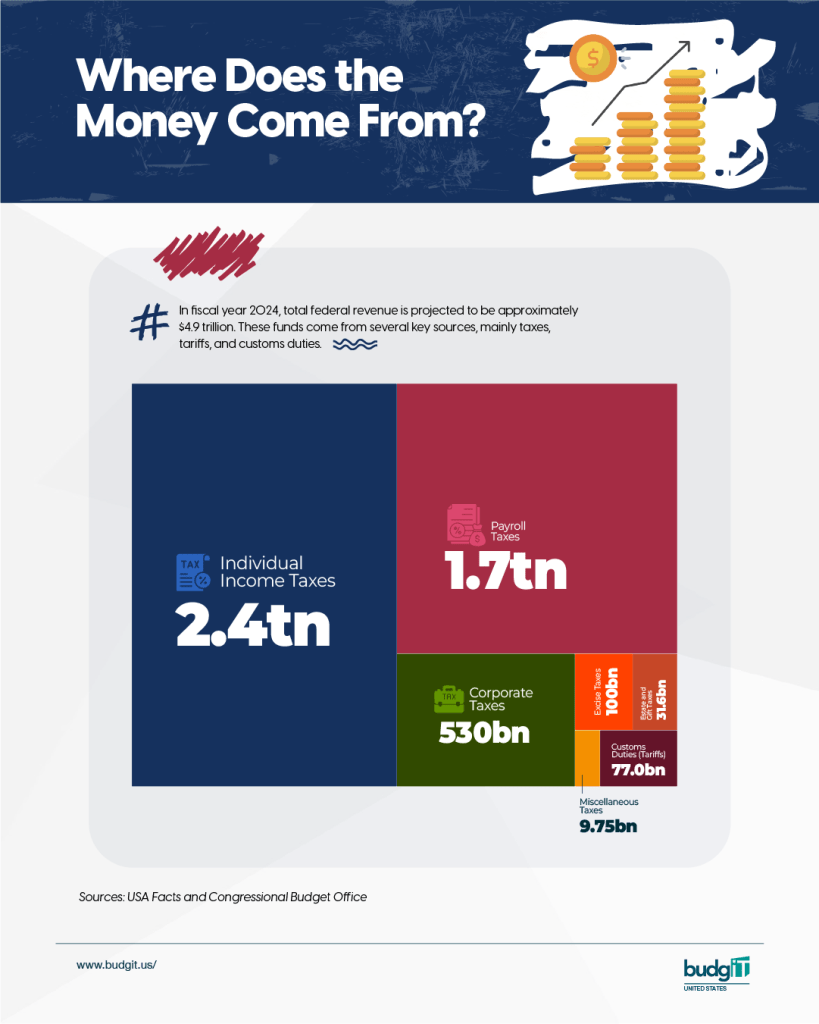

In fiscal year 2024, total federal revenue is projected to be approximately $4.9 trillion. These funds come from several key sources, mainly taxes, tariffs, and customs duties.

- Individual Income Taxes: This is the largest source of federal revenue, projected at $2.4 trillion. These taxes are levied on individuals’ earnings.

- Payroll Taxes: These taxes, totaling $1.7 trillion, are contributions from both workers and employers. They primarily fund Social Security and Medicare.

- Corporate Taxes: Taxes on corporate profits are a smaller, though still significant, source of revenue, projected at $0.53 trillion.

- Excise Taxes: These are taxes on specific goods, such as alcohol, tobacco, and fuel, projected at $0.10 trillion. These taxes are often used to discourage certain behaviors or fund related services (e.g., highway maintenance from gas taxes).

- Customs Duties (Tariffs): Taxes on imported goods, projected at $0.08 trillion.

- Estate and Gift Taxes: This is the smallest source of federal revenue, consisting of taxes on the transfer of property after death or as gifts, which are projected to total $0.03 trillion.

- Miscellaneous Taxes: This category includes various other smaller tax sources, projected at $0.04 trillion.

Source: Treasury.gov

Why Are Revenues Declining in FY 2025?

The projected revenue decline across all categories in FY 2025 is the result of an economic slowdown and temporary tax policy changes. Slower wage growth, hiring freezes, and inflation have resulted in lower income and payroll tax collections. At the same time, some tax cuts and deferrals have temporarily lowered corporate tax revenue.

Despite the dip, the Congressional Budget Office (CBO) predicts that as the economy stabilizes and temporary tax measures expire, federal revenue will rise to 17.1% of GDP in FY 2025, up from 16.6% in FY 2024. However, if inflation remains high and corporate profits remain low, this modest recovery may not be sufficient to offset revenue losses.

Understanding how the government raises money is the first step toward holding it accountable for how it spends that money. As citizens, being informed about the budget empowers us to ask better questions, advocate for smarter investments, and ensure our priorities are reflected in federal spending. There are several ways to learn about the US government spending, such as usaspending.gov, where you can find federal spending information; educational platforms like usafacts.org; or reading informational pieces like this from BudgIT at budgit.us. Our next article will look at US expenditure, specifically government spending priorities and their domestic and global implications.

Abiola Afolabi, International Growth Lead at BudgIT, and Rebecca Nzerem, Communications Officer at BudgIT, write from Chicago, IL.