The 2026 City of Chicago budget

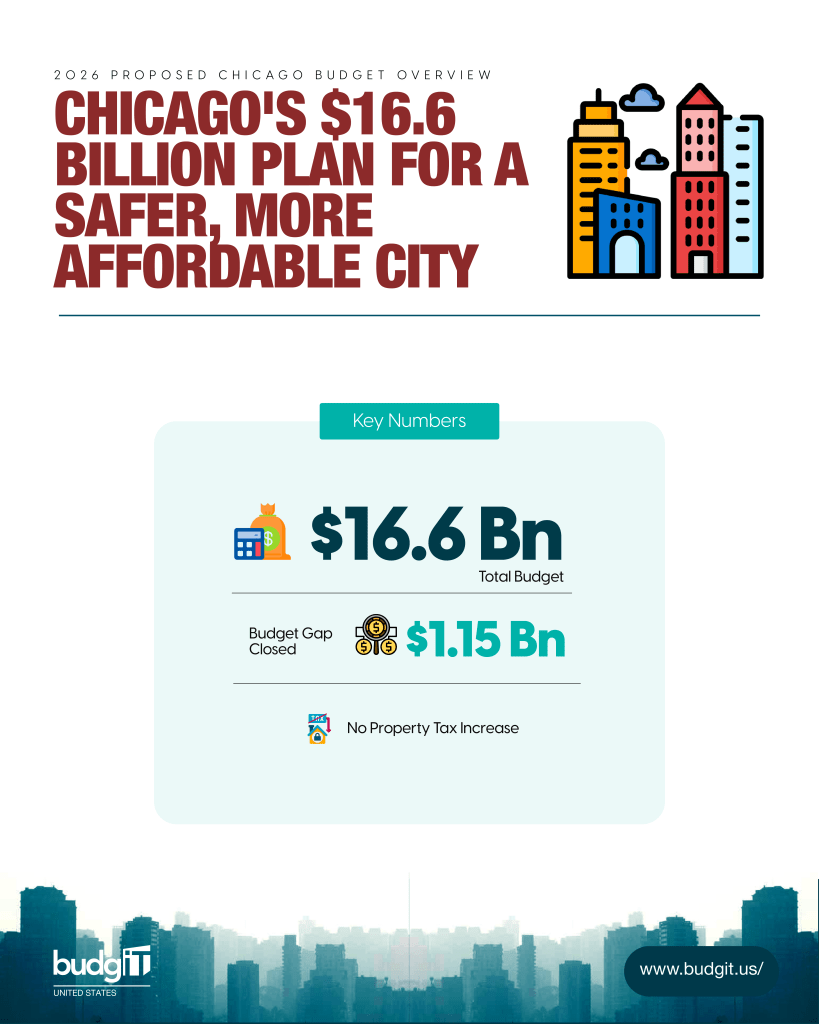

Chicago is staring down its largest budget shortfall in a decade, with a projected $1.1 billion gap. Yet, Mayor Brandon Johnson’s proposed $16.6 billion FY2026 “Protecting Chicago” budget dares to close it without broad-based tax hikes. Instead, the city leans on targeted new revenues, strategic restraint, and creative refinancing to stabilize finances while advancing Johnson’s equity-centered agenda.

Presented on October 16, 2025, this is Johnson’s third budget and perhaps his most defining. Sitting at the crossroads of fiscal discipline and social justice, it aims to protect essential services, fund community safety, and invest in public education, all amid persistent structural pressures such as pension costs, a slow post-pandemic commercial recovery, and growing demand for public investment. This article examines the FY2026 proposal’s three dimensions of revenue innovations, spending priorities, and fiscal sustainability before concluding with a discussion of its political feasibility and equity implications.

Navigating the Fiscal Challenge

Chicago entered FY2026 with a daunting $1.1 billion shortfall, a tenfold increase from the $145 million shortfall in 2025. Typically, cities turn to property or sales tax hikes to fill such gaps. But Johnson’s approach seeks to “protect working families” while modernizing the city’s fiscal tools.

Budget Director Annette Guzman described the plan as “responsible progress, protecting services while restoring fiscal credibility.” The strategy relies on innovative approaches such as generating $540 million through new and expanded revenue measures, including new fees for social media users, bringing back an employer tax, increasing taxes on gaming and cloud services, and reallocating extra funds from Tax Increment Financing (TIF) to implement cost-efficient strategies to ensure fiscal efficiency.

Where the Money Comes From: Chicago’s New Revenue Mix

Rather than rely on across-the-board tax increases, the administration introduces a slate of targeted, modern revenue measures designed to capture value from digital activity, corporate scale, and underused reserves. The city’s plan is set to earn approximately $540 million in revenue through new and expanded revenue measures. The proposed bill estimates that a new and controversial $1 monthly user fee on large social media platforms, specifically those with over 500,000 users in Chicago, could raise approximately $60 million annually.

The proposal mirrors ideas floated in California and the EU, making Chicago a potential national test case. The City also proposes reinstating a modest head tax of $4 per employee per month on large companies with more than 50 employees that are either headquartered in the city or operate there. The program, which was abolished in 2014 to encourage business retention, is projected to yield $120 million in savings. City finance officials argue that this fee structure spreads costs more equitably among major employers benefiting from Chicago’s infrastructure and workforce.

![]()

![]()

![]()

Chicago legalized on-site sports betting in 2021, but it has yet to fully capitalize on the increase in online betting. The FY2026 plan includes a 2% surcharge on gross receipts from online sports betting operators, estimated to generate $25 million in FY2026 and potentially double by 2028 as the market matures. The proceeds will go toward youth development and addiction prevention programs. To capture revenue from the growing digital economy, the city imposes a 2.5% Cloud Computing Usage Tax, which is expected to raise $40 million. This modernizes Chicago’s current amusement and lease taxes, indicating a shift toward taxing digital consumption and corporate IT services.

In a smaller but symbolic move, the city will increase mooring and docking fees at its marinas by 10%, raising $3.5 million, which will be used to fund coastal resilience and sustainability projects along Lake Michigan. The general operating budget and Chicago Public Schools will receive the city’s most significant revenue source, a $290 million TIF surplus. This follows a recent trend of using dormant or underutilized TIF accounts to relieve fiscal pressure, though critics argue it delays structural reform.

Collectively, these new and expanded revenue measures total approximately $540 million, covering nearly half the projected gap while aligning with the administration’s goals of equity, modernization, and fairness.

Where the Money Goes: Spending Priorities and Public Investment

The spending priorities in the FY2026 budget are what really matter, even though the revenues get a lot of attention for being new. Johnson’s plan is based on what he calls “the infrastructure of care,” which includes housing, education, health, and public safety.

- $195 Million allocation for youth development and education. More Chicago Public Schools will get an extra $195 million, most of which will go toward keeping staff stable as the federal ESSER (Elementary and Secondary School Emergency Relief) funds run out. This includes $40 million in targeted grants for STEM, literacy, and after-school programs in neighborhoods that don’t have enough resources. Johnson said during his budget speech, “Investing in education is not up for debate when it comes to long-term safety and mobility.”

- $75 million more for mental health and crisis response. The administration wants to make the Crisis Assistance Response and Engagement (CARE) program available throughout the city. Instead of sending police to nonviolent 911 calls, they would send mental health professionals. The plan will build new clinics in Englewood, Austin, and Uptown. This could double the number of people who can get help and save up to $10 million a year on police overtime.

- $90 million for affordable housing and homelessness. The budget sets aside $90 million for affordable housing and rapid rehousing programs, building on the “Bring Chicago Home” initiative. This money will come from partnerships with the state and private donors. The goal is to help the 68,000 people in Chicago who are homeless each year.

- The budget for public safety and community stability is $1.94 billion. The Police Department’s $1.94 billion budget remains Chicago’s largest single expense. The administration wants to cut $260 million in overtime costs by moving staff around and keeping a partial hiring freeze in departments that aren’t critical. This approach will save the city about $120 million. A new $100 million Community Safety Fund will pay for things like hiring young people, stopping violence, and bringing neighborhoods back to life. It will be based on similar programs in New York and Los Angeles.

- Managing debt and being financially strong, the city will refinance its debt to keep its cash flow steady, saving $150 million in the short term, and keep a $90 million rainy-day fund. Pension contributions are still fully funded to keep credit stable and avoid a downgrade, which is a big worry for rating agencies.

Equity, Sustainability, and Political Viability

The Johnson administration calls this budget a test of progressive governance: can a major U.S. city close a billion-dollar gap without cutting spending?

The plan spreads out the cost of government in a way that favors fairness by taxing big companies and digital giants while keeping rates low for people with low and middle incomes. The Johnson administration aims to close long-ignored neighborhood gaps with new investments in housing, education, and public health.

While these are great plans, there are still challenges with the revenue measures, especially the head tax and social media fee, which are being fought against by business groups who say they could hurt competition. Some people wonder if one-time fixes like TIF transfers and refinancing can keep things stable in the long term without changing the way pensions work. Analysts say Johnson’s 2026 budget could be his most daring and dangerous move due to its creativity and execution.

Examining the Fiscal Outlook

The budget positions Chicago for short-term stability, but the road ahead remains complex. Pension payments still take up about a quarter of the city’s budget. The downtown property market has been weak since COVID-19, which makes it hard for growth to happen in the future. In the meantime, the Trump administration’s second term brings new federal austerity, which adds to the uncertainty about the economy. The 2026 proposal is still a step toward modernizing Chicago’s financial system by adding digital-age taxes, making budgeting more fair, and putting long-term health ahead of quick fixes. The main question as the City Council discusses the proposal this winter will be whether Chicago can really “protect” both its balance sheet and its social contract.

Overall, it is obvious that Mayor Johnson’s FY2026 budget isn’t to avoid taxes but to redefine how cities address fiscal justice. It combines bold, innovative approaches to fiscal sustainability while being inclusive and cautious. If this budget succeeds, Chicago could set an example for other progressive cities on how to close gaps without making things worse. However, if it fails, it will demonstrate how political and economic issues can undermine even the most well-laid plans for fiscal policy. The “Protecting Chicago Budget” shows a clear change, whether you like it or not. Chicago now aims to balance its values, not just its books.

Abiola Afolabi, International Growth Lead at BudgIT, writes from Chicago, IL.