A Simplified Guide to Understanding U.S. Federal Spending Priorities

Public budgets are not just for politicians and economists; everyone should understand them on a basic level because they define government commitments, reflect national priorities, and directly affect the well-being of our communities and individuals. While its complexities can be intimidating, this article aims to simplify US federal spending by breaking it down into clear, understandable categories and priorities.

Every year, a new budget blueprint detailing spending priorities and anticipated revenue is unveiled as the U.S. federal budget fiscal year begins on October 1. Although revenue is only anticipated to reach $5.16 trillion in FY2025, the federal government has announced an ambitious spending plan of $7 trillion (Economics Insider, 2025). This projected $1.8 trillion deficit has generated heated discussion across the political spectrum and highlights a growing structural imbalance.

Interestingly, this budget plan was created during the Biden administration and has since become a point of contention after the Trump administration took office. A politically divided Congress has been further strained by budgetary disputes, which have brought up pressing issues regarding long-term national priorities and fiscal sustainability.

The federal budget is composed of three primary components: revenue, expenditures, and the resulting deficit or surplus. Revenue is the total amount of money received by the government, mostly from payroll taxes (which pay for Social Security and Medicare), corporate taxes, individual income taxes, and excise taxes. Expenditures are divided into mandatory spending (such as Social Security and Medicare), discretionary spending (such as defense and education), and interest payments on the national debt. When expenditures exceed revenue in a fiscal year, a budget deficit is created, which is then financed through borrowing. In contrast, a surplus occurs when revenue exceeds spending. The cumulative effect of annual deficits adds to the national debt, which has recently reached record highs at $36 trillion, largely due to high government spending.

Understanding Government Spending Priorities

As previously stated, the US federal budget is broadly divided into two categories: mandatory and discretionary spending. Simplifying the federal budget begins with an understanding of these two “buckets.”

Mandatory vs. Discretionary Spending: The Two Main Buckets

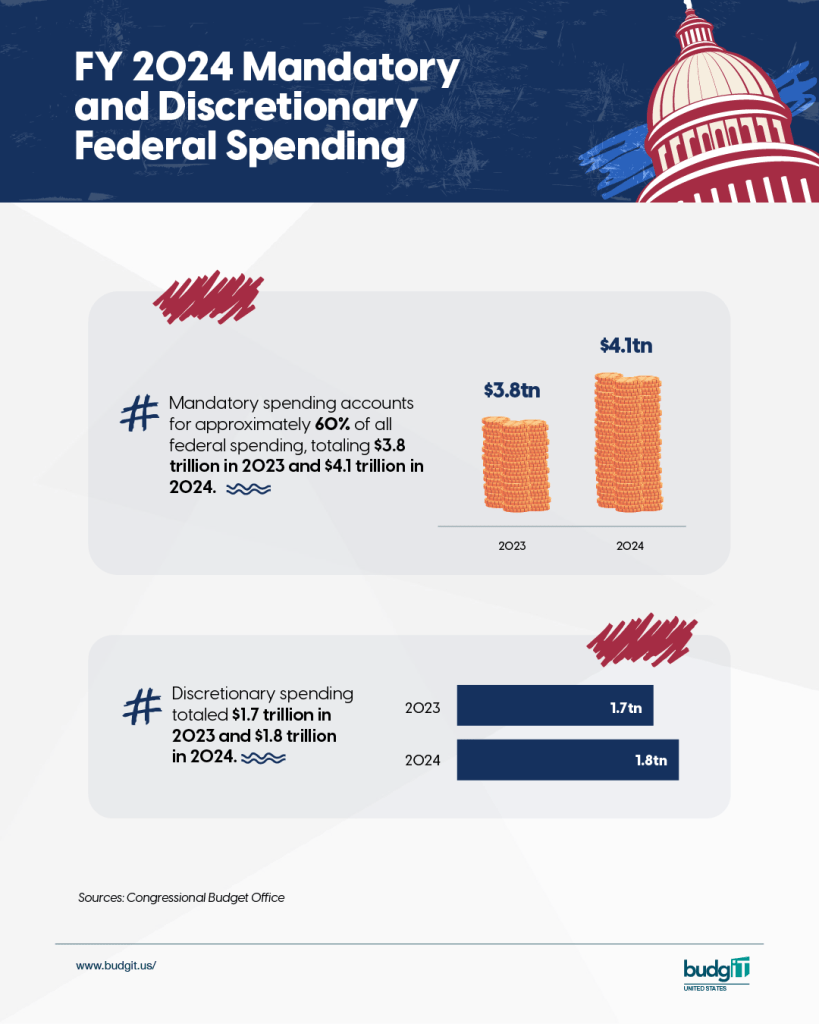

Mandatory spending accounts for approximately 60% of all federal spending, totaling $3.8 trillion in 2023 and $4.1 trillion in 2024. Mandatory spending is the term used to describe spending that is predetermined by current legislation and is frequently referred to as “entitlement programs. These funds are automatically allocated toward significant spending programs such as Social Security, Medicare, and Medicaid unless Congress changes the underlying laws.

Discretionary spending: This is the portion of the budget that Congress decides on each year through appropriations bills. Unlike mandatory spending, these funds are not automatically renewed and must be approved each year. Major areas of discretionary spending include national defense, education, transportation, environmental protection, and scientific research. Discretionary spending totaled $1.7 trillion in 2023 and $1.8 trillion in 2024.

Typically, mandatory spending accounts for roughly two-thirds of the total federal budget, while discretionary spending makes up the remaining one-third.

The Largest Spending Categories

When we look at the entire federal budget, a few categories consistently consume the largest shares. The top three categories are generally Social Security, Healthcare (Medicare and Medicaid), and National Defense; together, they account for a significant majority of all federal expenditures. In FY2025, the total expenditures for these three categories are projected to be $1.04 trillion, $635 billion, and $613 billion, respectively.

Social Security: Securing Our Seniors and Vulnerable

Social Security is the largest single federal program and serves as a vital safety net for millions of Americans. It provides financial assistance to retirees, disabled people, and the survivors of deceased employees. Its priority status stems from a long-standing national commitment to ensuring economic stability for its citizens, particularly those who have contributed throughout their working lives. Social Security is primarily funded through dedicated payroll taxes. In 2024, social security was capped at $1.3 trillion, accounting for 22.4% of the budget. As of recent estimates for 2025, Social Security is at $1.6 trillion, accounting for over 20% of the total federal budget.

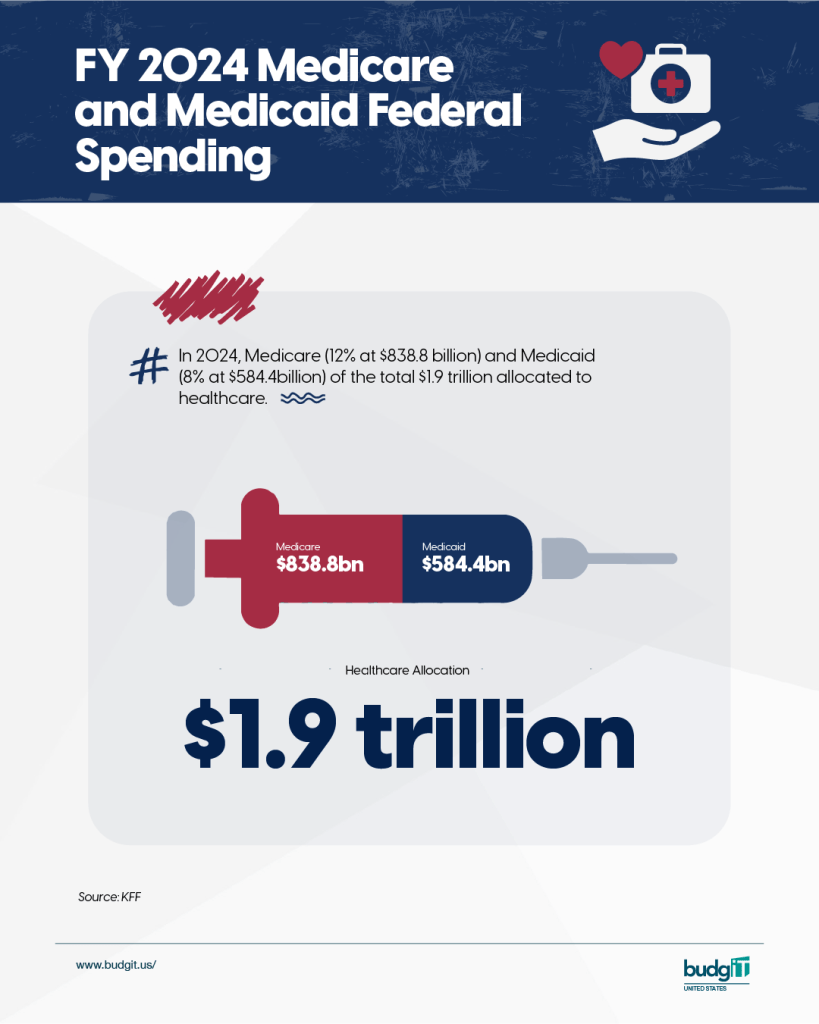

Healthcare (Medicare & Medicaid): Health for Millions

Medicare and Medicaid are the federal government’s two largest health insurance programs, playing a critical role in public health and access to medical care. The Medicare program provides health insurance primarily for Americans aged 65 or older, as well as some younger people with disabilities. On the other hand, the Medicaid program offers health coverage to low-income individuals and families, including children, pregnant women, and people with disabilities. Both account for a sizable and growing portion of the federal budget, Medicare accounting for $838.8 billion and Medicaid $584.4 billion, reflecting the country’s commitment to healthcare access as well as the rising cost of medical services.

National Defense: Protecting Our Nation

Every year, the largest portion of discretionary spending goes toward national defense. This category encompasses a wide range of expenses, such as military operations, employee pay and benefits, equipment and weapon purchases, defense research and development, and various veteran benefits. Its prioritization reflects the government’s primary responsibility for national security and role in global affairs. In 2024, the federal government spent $877 billion on national defense and proposes to spend $850 billion in 2025

Other Significant Spendings

While Social Security, Healthcare, and National Defense dominate the budget, several other areas receive significant federal investment.

Net Interest on the National Debt—The Cost of Borrowing

Just like individual debts, the U.S. government makes interest payments on its accumulated debt. As the national debt has grown and interest rates have fluctuated, these payments have become a substantial and increasing component of the budget, impacting the government’s fiscal flexibility and ability to fund other priorities. The US Government Accountability Office (GAO) reports that interest on public debt has risen dramatically over the past three fiscal years, rising from $497 billion in fiscal year 2022 to $909 billion in fiscal year 2024 (an 83 percent increase).

Education: Investing in Our Future

The federal government also plays a significant role in education, providing funding for K-12 schools, student financial aid (like Pell Grants), and support for higher education and research initiatives. In 2024, the US government allocated $268 billion toward education; these investments help improve educational outcomes and foster a skilled workforce.

Transportation & Infrastructure: Building and Maintaining

Federal funds are allocated to build, maintain, and improve the nation’s transportation infrastructure, including roads, bridges, public transit systems, airports, and waterways. In 2024, $40 billion was allocated to transportation and infrastructure to improve economic activity, trade, and daily commuting.

Other Categories

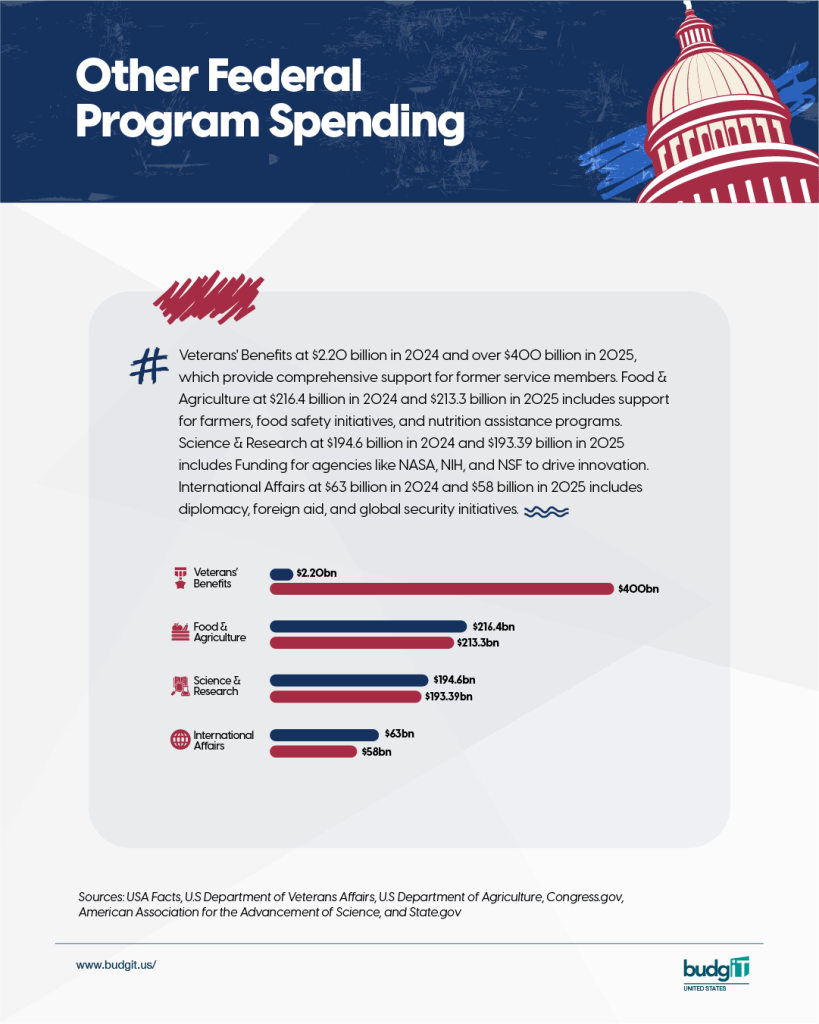

Beyond these major areas, federal dollars also support a wide range of other vital functions, including Veterans’ Benefits at $2.20 billion in 2024 and over $400 billion in 2025, which provide comprehensive support for former service members. Food & Agriculture at $216.4 billion in 2024 and $213.3 billion in 2025 includes support for farmers, food safety initiatives, and nutrition assistance programs. Science & Research at $194.6 billion in 2024 and $193.39 billion in 2025 includes Funding for agencies like NASA, NIH, and NSF to drive innovation. International Affairs at $63 billion in 2024 and $58 billion in 2025 includes diplomacy, foreign aid, and global security initiatives.

There are many intricacies to balancing public budgets. In the US, the federal government often faces challenges and difficult tradeoffs with Congress regarding competing spending priorities, such as choosing between increased funding for defense or social programs, and between infrastructure or education. Coupled with tough economic conditions that impact government revenues and increase the demand for government assistance programs, often leading to escalating costs of healthcare and the growing burden of debt interest payments, immense pressure is exerted on the budget. Budget decisions are often inherently political, involving negotiations and compromises among various parties and interests.

Conclusion: Why should you be concerned about government spending?

Government spending has a direct impact on the lives of all citizens, so it is critical to pay close attention to it. The US federal budget reflects national priorities, and as a tax-paying citizen, you should be involved, as unchecked spending can lead to higher taxes, inflation that erodes purchasing power, and increased borrowing costs for everything from mortgages to credit cards. Additionally, government spending determines how it provides essential public services like healthcare, education, feeding, and housing; a strain on these could reduce quality of life, and expanding them could also increase the national debt burden for future generations, potentially limiting economic growth and the nation’s ability to respond to unforeseen crises.

Ultimately, an informed citizenry is critical to ensuring public funds’ efficiency, fiscal responsibility, and government accountability, ensuring that the federal budget serves the collective well-being and long-term prosperity of the country.

References

- U.S Government Accountability Office (GAO)

- Congressional Budget Office (CBO). (Various reports on the federal budget and economic outlook).

- Office of Management and Budget (OMB). (The President’s Budget).

- United States Department of the Treasury. (Various financial reports).

- Reputable non-partisan organizations focusing on fiscal policy (e.g., Committee for a Responsible Federal Budget, Peter G. Peterson Foundation, KFF).

- USA Facts (Various reports on the federal budget and economic outlook).

United States Department of Agriculture (Financial reports for Agriculture)

Abiola Afolabi, International Growth Lead at BudgIT, and Rebecca Nzerem, Communications Officer at BudgIT, write from Chicago, IL.